Residents in Lambeth and Southwark are facing a debt crisis as the cost of living and financial hardship is taking it's toll. Many face eviction or are drowning in unmanageable debt. We need your support to be able to continue to provide high quality, free debt advice to those in our community.

Categories

Beneficiaries

The 2024 CAP Client Report shows most fall into debt due to mental health struggles or low income, with unemployment also a factor (10% of new clients, up from 6%). Each had 12 debts on average, totalling £10,266. Many lack basics: 51% couldn’t afford a cooker, 53% a fridge/freezer, 57% a washing machine, 63% a bed, 57% a sofa, 56% carpets, and 39% curtains. Poverty traps people in higher costs — no freezer means no batch cooking, and laundrettes cost more than a washing machine at home.

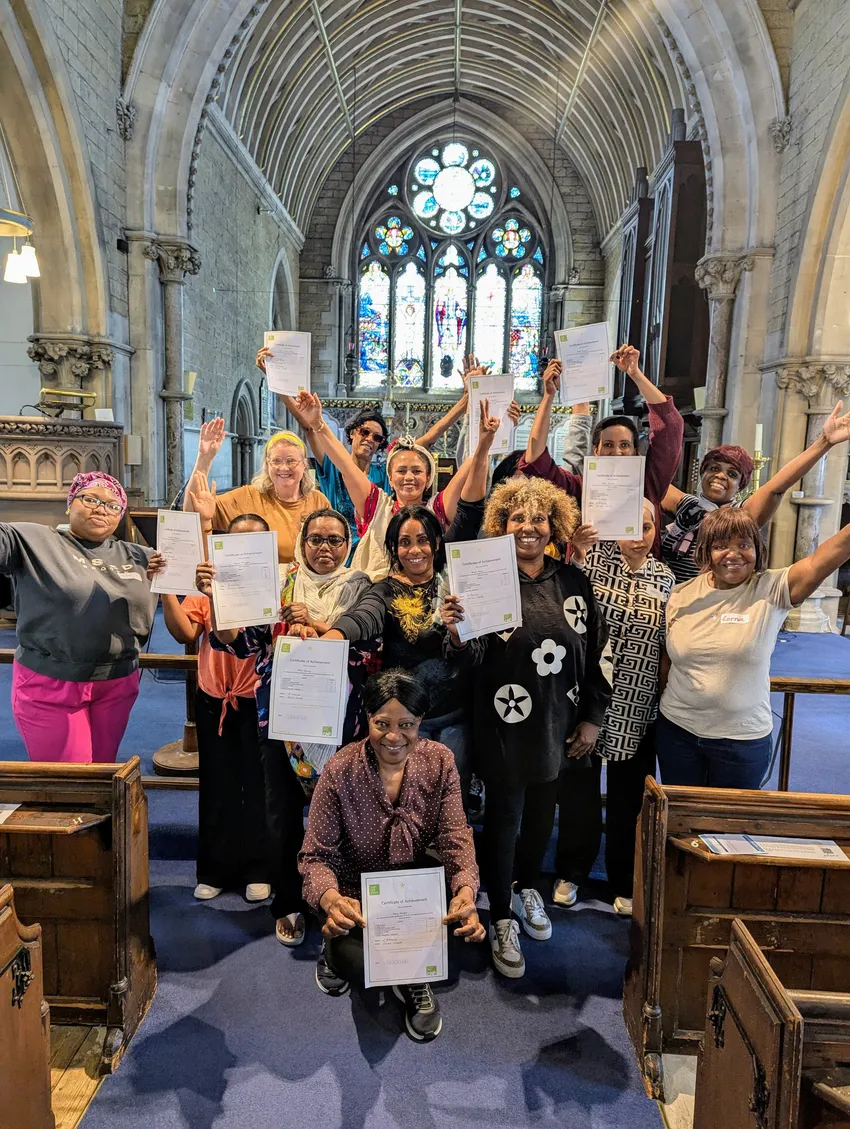

Since 2015, our debt centre has helped over 140 individuals become debt-free, with many more on the journey. Our coaches provide in-home support during times of real vulnerability — offering practical debt advice alongside emotional care. The impact of these visits is profound. We also link clients to CAP services like job clubs, life skills, and money coaching, while ensuring income is maximised through benefits checks. Our goal is to see every client financially secure and thriving beyond debt